So let me get this straight, Mr. President, you said that “I didn’t run for office to help out a bunch of fat-cat bankers on Wall Street,” but the facts belie otherwise. First the money quote:

Now let’s see how that is working out for you:

While the world suffers, Wall Street pays itself record bonuses, larger even than the peak year of 2007, by taxing the productive economy to maintain an extravagant lifestyle. These bonuses are being paid with your money, and your children’s money, if you hold US dollars.

And while this happens, the US credit card banks are raising interest rates to 20+% even on customers with excellent payment records and jobs which is certainly usury, and with an arrogant impunity. The insider trading scandals and tales of government graft yet to be told are so blatant and shocking that only a captive mainstream press keeps them from being investigated.

Wall Street firms set to break new records in 2009 with pay rising to $140bn; Bailed-out insurance giant AIG paid “retention bonuses” to kitchen staff

Wall Street firms are set to break new records with employee pay set to rise to $140bn this year. Meanwhile, it has been reported that the bailed-out insurance giant AIG paid “retention bonuses” to kitchen staff earlier this year from a $168m pot, that was ostensibly designed to keep staff from leaving the government controlled firm.

Workers at 23 top investment banks, hedge funds, asset managers and stock and commodities exchanges can expect to earn even more than they did in the peak year of 2007, according to an analysis of securities filings for the first half of 2009 and revenue estimates through year-end by The Wall Street Journal.

The Journal reports that total compensation and benefits at the publicly traded firms it analyzed, are on track to increase 20% from last year’s $117bn — and to top 2007’s $130bn payout. This year, employees at the companies will earn an estimated $143,400 on average, up almost $2,000 from 2007 levels.

Average compensation per employee at investment bank Goldman Sachs, is set to reach about $743,000 this year, double last year’s $364,000 and up 12% from about $622,000 in 2007, according to the Journal analysis…

via Jesse’s Café Américain: Wall Street Set to Pay a Record $140 Billion In Bonuses Topping 2007.

Mr. President, you are being played, or you are playing the American people. I believe your rhetoric is nothing more than a smokescreen, since the financial sector was your largest campaign contributor in 2008. And you certainly don’t want to anger the money men that will have to fill your campaign coffers in 2012.

Let’s take a look at your top Obama contributors during the 2008 presidential election:

The financial “fat cats” of Goldman Sachs, Citigroup, JPMorgan Chase, UBS, Morgan Stanley and GE contributed a total of $3,948,447 to the Obama campaign in 2008.

See the entire scoop at OpenSecrets.org

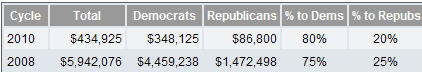

Now let’s see how much Goldman Sacks alone has control over the Democrat party by looking at Goldman’s contributions in 2008 to the Democrats. As you can see from the cut below, Goldman Sachs contributed a total of $5,942,075 with Democrats receiving the bulk of those contributions at $4,459,238:

See the complete table at OpenSecrets.org.

To illustrate just how fat the fat cats are using taxpayer funds, take a look at this article from Bloomberg. I’ll just paste a couple of items that show you the extent of fat that these cats received from the taxpayer, courtesy of our elected representatives:

Interest Expense

“The issue that people have focused on — TARP and the payback of TARP money — is insignificant compared with the way they’ve been able to use federally guaranteed programs and their access to the Fed window,” saysPeter Solomon, founder of New York-based investment bank Peter J.Solomon Co.

Those benefits, along with a drop in the Fed’s benchmark borrowing rate to as low as zero, have slashed Goldman Sachs’s interest costs to the lowest this decade, though its debt was higher in the first nine months of 2009 than in any comparable period except the previous two years. For those three quarters, the firm’s interest expense fell to $5.19 billion from $26.1 billion a year earlier.

“You can’t give a small group of firms this privilege, where they get free money from the Fed and a taxpayer guarantee and they can run the biggest hedge fund in the world,” Niall Ferguson, a professor of history at Harvard University and author of “The Ascent of Money: A Financial History of the World,” said at a Nov. 18 panel discussion in New York.

‘Using Your Money’

That view is shared by Solomon. “Everybody thinks they’re a bank, but they’re a hedge fund,” he says. “The difference is that this year they’re using your money to do it.”……………

Value-at-Risk

The government is acting schizophrenically by arguing that Goldman Sachs needs taxpayer support because it poses a risk to the financial system at the same time as it’s failing to do anything to curtail that risk, says Nobel Prize-winning economist Joseph Stiglitz, who teaches at Columbia University in New York.

“We say they’re too big to fail, but we refuse to do anything about their being too big to fail,” Stiglitz says. “We say that they represent systemic risk, but we don’t regulate them effectively.”

‘Biggest Single Gift’

Stiglitz also points to the Fed’s $182.3 billion AIG bailout as an example of how policy has been tilted to support Goldman Sachs.

“The biggest single gift was the AIG rescue,” he says. “No one has ever provided a good argument for why we did it other than we were bailing out Goldman Sachs.”

Political Contributions

Goldman Sachs and its employees have donated $31.4 million to U.S. political parties since 1989, more than any other financial institution and the fourth-highest amount of any organization, according to the Center for Responsive Politics, a Washington research group.

The President wants to keep those fat cats happy in order to keep those campaign coffers full, so don’t expect anything but some minor tweaks to financial reform and a lot of hot air coming from our elected representatives. They know where their bread is buttered. Change you can’t believe in…..

Full disclosure: I did not vote for either major party presidential candidate in 2008.

Update 2009-12-28:

“I love you and believe in you,” said the e-mail sent on Feb. 17. “If you want my ear/voice — e-mail,” it said, signed “Pete.”

Heh, now that’s innocent, right?

Let’s talk about what’s going on here, because this is not limited to a handful of interests – it is in fact widespread and part and parcel of the corruption that has swept our nation.

The “revolving door” game – and the so-called “perks” of being a lawmaker, including the ability to travel to exotic (and expensive) places on the dole of others – has always been an issue.

via Gee, Who WASN’T Bribed? – The Market Ticker.

As you can plainly see, you can’t depend on Congress or the President to stop the Fat Cats, since it’s in their own best interests to make sure the Fat Cats stay that way – at your expense.

Dick Locher

[…] was merely going to update my previous post Change you can believe in – the “Fat Cats” will keep getting fatter, but I thought the “What amazes me most of all is that politicians can be bought so […]