Did you get your $38 billion tax break today?

No? Well, it appears that Citigroup (C) got their $38 billion tax break today. And don’t they certainly deserve such rewards for all they’ve done for the well-being of the economy and the taxpayer? I’m not a tax wiz be any stretch, but on the surface, this $38 billion reward given C seems a bit excessive.

Citigroup is 34% owned by the US government, or the taxpayer if you prefer. So why would we want to give Citigroup another $38 billion on top of the $45 billion in TARP and the untold billions of other bailout government programs? I’m not sure, but here are a couple of interpretations from those more versed than I.

Without the waiver, the bank would have stood to lose much of those tax benefits as it recovered and it could have been significantly weakened, if not imperiled. Of the $38 billion of tax benefits, it has been allowed to count about $13 billion toward its regulatory capital requirements.

The ruling raises questions about whether federal officials moved too quickly to allow Citigroup to begin untangling itself from the government, given its fragile health. It also may lead to further scrutiny from lawmakers about whether the bank received favorable treatment.

via A Tax Break for Citigroup Comes With Repayment of Bailout – NYTimes.com.

How much?

The “exemptions” are on roughly $38 billion in “future earnings.” The actual value of this exemption could be anywhere between zero (if Citi makes no profit) to roughly 40% of the whole, or $15 billion.

Obama was touting the “profits” made by Treasury on the TARP repayments. What he wasn’t saying is that not only did we flush the money (from TARP) that went into Chrysler (disclosed last night), we now find out that at the same time he was “touting” the so-called “profits” The President was handing that money straight back to the bailed-out companies via tax breaks!

via Treasury Handed Out $38 Billon Tax Exemption? – The Market Ticker.

“The government is consciously forfeiting future tax revenues. It’s another form of assistance, maybe not as obvious as direct assistance but certainly another form. I’ve been doing taxes for almost 40 years, and I’ve never seen anything like this, where the IRS and Treasury acted unilaterally on so many fronts.”

-Robert Willens, an expert on tax accounting

The ongoing transfer of wealth from the middle class to the top 1% continues unabated.

The Treasury Department, via the IRS, has made a terrible deal with Citigroup for TARP repayment: They repay $20 billion in TARP money, and in exchange we give them keep $38 billion in tax abatements.

WTF?

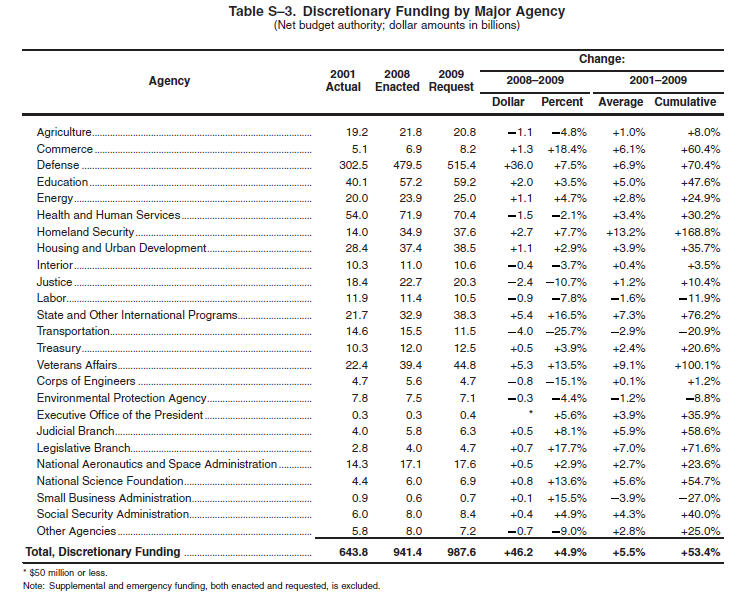

WTF, indeed! Just to show you how much $38 billion can buy, let’s take a look at the 2008 Federal Budget and how it was distributed. I’ll post departments that come close to the $38 billion Citigroup gift:

What $38 billion can fund

So as you can see, $38 billion is more money than what it costs for fund the departments of Agriculture ($21.8 billion), Commerce (6.9B), and EPA ($7.5B) combined in 2008. Citigroup’s $38B tax break is almost as much as the $39.4B funding for Veterans Affairs. Even if the Citigroup tax exemption is the $15B offered by Karl Denniger – Treasury Handed Out $38 Billon Tax Exemption? – The Market Ticker, that would be more than the total funding for the Corps of Engineers ($5.6B), National Science Foundation ($6.0B) and Legislative Branch ($4.0B) combined. I’m sure you can determine even better relationships between the Citigroup giveaway and useful ways of spending taxpayer money.

While that seems bad enough, there’s the story of the IRS auditing a single mom who makes $20K a year because she lives in Seattle:

“I asked the IRS lady straight upfront — ‘I don’t have anything, why are you auditing me?’ ” Porcaro recalled. “I said, ‘Why me, when I don’t own a home, a business, a car?’ “

The answer stunned both Porcaro and the private tax specialist her dad had gotten to help her.

“They showed us a spreadsheet of incomes in the Seattle area,” says Dante Driver, an accountant at Seattle’s G.A. Michael and Co. “The auditor said, ‘You made eighteen thousand, and our data show a family of three needs at least thirty-six thousand to get by in Seattle.”

“They thought she must have unreported income. That she was hiding something. Basically they were auditing her for not making enough money.”

Seriously? An estimated 60,000 people in Seattle live below the poverty line — meaning they make $11,000 or less for an individual or $22,000 for a family of four. Does the IRS red-flag them for scrutiny, simply because they’re poor?

via Danny Westneat | $10 an hour with 2 kids? IRS pounces | Seattle Times Newspaper.

So the bottom line seems to be if you are a large, corrupt, financially irresponsible, fraudulent bank that’s politically connected, you get a huge taxpayer bailout and kisses from the IRS. If you are a struggling single mom making $20K you get audited for being responsible.

Jerry Holbert

Advertisement:

If you are looking for home, auto, life, health or business insurance, take a look at NetQuote.com. The people at NetQuote make shopping for insurance an easy process. Just enter your requirements and you will be sent numerous offers that you can review before making a final decision. NetQuote has been doing business since 1989 and they offer a comprehensive selection of insurance offerings, which allows you to shop, compare and save money. You can select from policies offered by The Hartford, Amica, Nationwide and AARP, just to name a few of the highly respected insurance firms offered at NetQuote.

Shopping for insurance at NetQuote is as easy as entering your zip code and then completing the information fields. Once you submit your information NetQuote does the rest and within minutes you will be able to review quotes sent directly to your email address. Save time and money by getting your insurance quotes through NetQuote.