The COBRA Continuation Coverage Assistance, which was made available under ARRA (stimulus) is ending for millions who started on the plan in March. This subsidy paid 65% of the cost of COBRA for a nine month period: The premium reduction applies to periods of health coverage beginning on or after February 17, 2009 and lasts for up to nine months for those eligible for COBRA during the period beginning September 1, 2008 and ending December 31, 2009 due to an involuntary termination of employment that occurred during that period.

I’ll just put the main points in the list below:

- If you applied for the subsidy on or before March 1, 2009, you lost that subsidy on December 1, 2009.

- If you applied for the subsidy after March 1, 2009, you are still eligible for nine months worth of subsidy.

- If you are laid off AFTER December 31, 2009, you will not be eligible for a subsidy unless Congress agrees to extend the subsidy.

According to Loss of COBRA aid puts people in health care bind: The coverage is so expensive, often exceeding a person’s monthly unemployment checks in some states, that only one in five unemployed American workers purchase COBRA, FamiliesUSA said in a report earlier this year.

There’s another catch: If a person drops COBRA now, he or she would not be able to return to the program if Congress approves legislation to extend the subsidies.

Millions of Jobless Lose Insurance Aid: Ron Pollack, executive director of Families USA, predicted that most people who lost their subsidies on Monday would not be able to pay the full cost of their premiums and would drop their coverage altogether.

He said that the broader health care legislation in Congress would help by establishing new insurance marketplaces with tax credits — but they would not be set up for several years, leaving millions of people stranded in the interim.

Some Democrats have introduced legislation outside of the health care bills to extend the Cobra subsidies a few months and even increase them. The subject may come up as part of a new jobs bill in the near future, but nothing has been approved so far.

2009-12-01: Thank you all for visiting and commenting on this post. Some of you touched on the issues that are behind these disturbing unemployment numbers and you are all correct. We have a government more inclined to bailout crooked corporations than helping the citizenry with job creation and debt management. The taxpayer, through the Federal Reserve, loans banks money at 0% and those same banks jack up the interest rates to 29% on many credit cards. Banksters and fraudsters continue to collect outrageous bonuses – funded by the taxpayer – while jobs are shipped offshore and factories close forever.

Regarding the self-employed, I spoke to a BLS representative and they indicate that self-employed are included in the unemployment rate. You can look at the questioning at How the Government Measures Unemployment. That’s not to say that there are gaps that aren’t covered, but the self-employed are counted in the mix. The self-employed may do a lot of work and not make any money, so they are working and unemployed and sometimes relying on payday loans.” And while the self-employed aren’t eligible for unemployment benefits, they pay the full-shot (around 15%) for Social Security (FICA)taxes, instead of the 7.5% that employed workers pay. There should be an insurance package that the self-employed can purchase that would allow them to collect some sort of unemployment benefit.

I was speaking to a friend of mine that is more to the right on most issues than I am and he asked me what I would do if I could change the way government operates. I told him that I would curtail corporate lobbying by any company that receives government contracts. There needs to be a separation between business and our elected representatives. The money that flows between them is corrupting both sides and it’s a revolving door between business and government. How many ex Goldman clowns have bounced between Goldman and the Treasury? Could that be why corrupt banks like Goldman were bailed out with trillions of dollars worth of guarantees and backstops? How did they convince Treasury to belly-up at par the billions that AIG owed them? They really didn’t have to convince anyone, since Goldman = Treasury!

While there are certainly a few honest, sincere and citizen focused elected representatives, they are in the minority. And, unfortunately, with the system we have now, when you throw out the bums, you only have other bums take their place. Without a valid third or even fourth party, there are few reasons for the two parties that we currently have to do anything differently, such as act in your best interest.

The “Real” unemployment rate in the US is now 22%

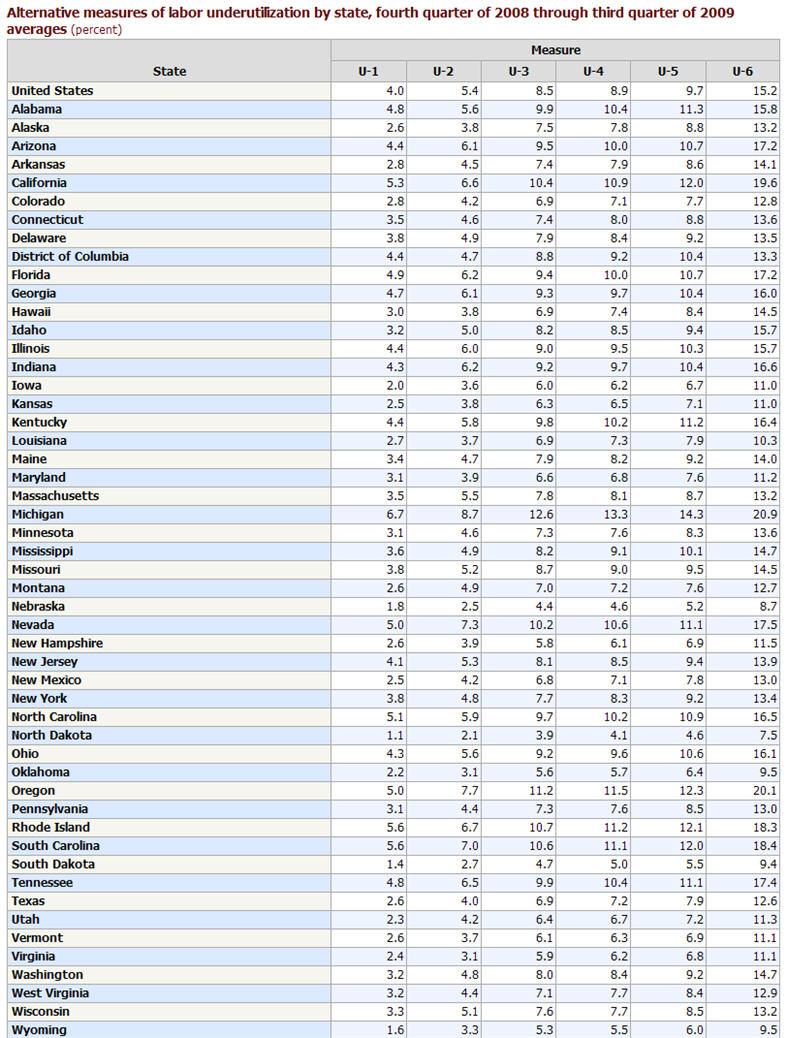

The media and government officials often tout the unemployment rate using the official, or U3 rate, which stands at 10.2% for October. While 10.2% unemployment is certainly bad enough – it’s the highest rate nationally excluding 1983s 10.8% – it pales when compared to the U6 unemployment rate. First let’s discuss the differences between U3 and U6 measures.

According to the Bureau of Labor Statistics (BLS) the U3 measure is described as “total unemployed, as a percent of the civilian labor force (official unemployment rate).” Now let’s take a look at the BLS U6 measure: Total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.

When including marginally attached workers and those forced to work part-time instead of full-time we have a national unemployment rate of 17.5%, which is nearly 70% higher than the U3 rate of 10.2%. That’s a dramatic increase from the normally quoted U3 unemployment rate, but even U6 fails to provide the actual percentage of people who are, or may be considered unemployed.

John Williams discusses alternative unemployment data sets at his Shadow Government Statistics site. Their service, in part, “exposes and analyzes flaws in current U.S. government economic data and reporting.” Once those flaws are included in the unemployment calculation – called the SGS Alternate – the unemployment rate reaches 22%. Shadow Government Statistics gives the following reason for SGS Alternate measure: “The SGS Alternate Unemployment Rate reflects current unemployment reporting methodology adjusted for SGS-estimated “discouraged workers” defined away during the Clinton Administration added to the existing BLS estimates of level U-6 unemployment.”

To clarify why the discrepancy between U6 and the SGS Alternate rate of 22%, I contacted the BLS and received the following answer to my question about the change in discouraged worker designation during the Clinton Administration:

“(P)rior to 1994 persons were not asked whether they had searched for work recently. If they gave one of the five “discouraged worker” reasons for not looking for work in the past 4 weeks, they were assumed to have “given up” the search for work, although they weren’t asked when they had last looked. As a result of the greater specificity introduced in 1994, the number of discouraged workers was cut approximately in half, from about 1.1 million in 1993 to 500,000 in 1994.”

About 600,000 people were removed from the unemployment calculations in 1994, so if you merely add those 600,000 to the current U6 number, the rate of unemployment would be much higher than 17.5% and would more accurately be reflected in the SGS Alternate unemployment rate of 22%.

To view the SGS Alternate graph, visit: Inflation, Money Supply, GDP, Unemployment and the Dollar – Alternate Data Series

The BLS now offers the U6 measure of unemployment for states. An example is New York’s U6 rate averages 13.4% for the period fourth quarter of 2008 through third quarter of 2009 at: Alternative measures of labor underutilization by state. So making the simple assumption that the SGS Alternate data is, on a national level, about 4.5% higher than U6, the unemployment rate in New York is closer to 17.9%, and that’s being conservative since the current unemployment rate is higher than the average presented at the BLS. Below is the latest unemployment measurements by state from the BLS:

When nearly 1 in 5 eligible New York workers are either unemployed or underemployed, we are made aware of the brutal state of employment. Maybe it’s time to spend more money on job creation, instead of pumping billions of dollars into the coffers of banking bonus babies and corrupt banks and institutions that were made too big to fail by two presidential administrations more concerned about campaign money than taxpayer needs.

A sliver of good news, according to John Williams, is that during the Great Depression the SGS Alternate measure of unemployment would likely be near 34%. Let’s hope our elected “representatives” don’t aim for those lofty unemployment levels.

If you would like to follow my Examiner.com posts, they are located at Rochester Unemployment Examiner’s Articles.

“When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it.” – Frederic Bastiat (1801-1850)

Reader, Stanford, was kind enough to send a link to a YouTube video that may better explain through humor what I have mentioned above. It’s worth a view:

Advertisement:

One way to get your mind off of news about layoffs, pay cuts and benefit reductions is to take a vacation, which can improve your mental outlook and recharge your system. One place you may want to visit to learn more about vacation rental homes is VacationRental.org. They offer a wide variety of vacation rentals that are aimed at all budgets. These rentals are fully furnished and consist of condos, villas, houses and apartments. For those looking at the warm breezes of Florida, take a look at their Florida Vacation Rentals. If snow and skiing is more your idea of a vacation, the Colorado Vacation Rentals might be more to your liking. Enjoy!

On November 6, 2009, President Obama signed legislation that extends unemployment benefits for 14 weeks in all states and 20 weeks in states that have 8.5% unemployment or higher. In New York, where I live, the unemployment rate currently stands at 8.9%, so New Yorkers are eligible for the 20-week extension. That extension now allows the unemployed of some states, including NY, to collect up to 99 weeks of benefits.

One drawback of the legislation is that those who lost unemployment benefits since the last extension was exhausted – about four weeks ago – will not be eligible to collect benefits for those missed weeks. It’s important to know that if you did lose your benefits during that four-week period, you will have to reapply for the benefits extension.

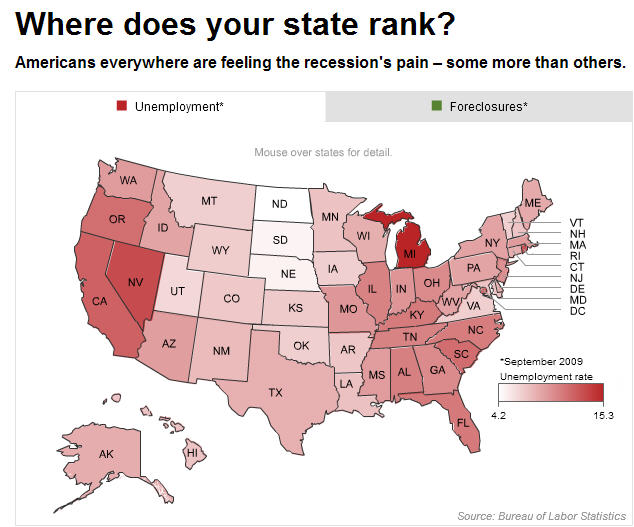

If you live in a state other than NY, take a look at the BLS report to see your state’s latest reported unemployment rate, or visit “Where does your state rank?” to use an interactive map. A static version of the map is presented below:

The New York Times has an FAQ article that answers some unemployment extension questions:Extended Unemployment Benefits: F.A.Q.

For additional information about NY unemployment, see: How long can you collect unemployment benefits in New York?

CNNMoney.com

Advertisement:

5.11 Tactical Series creates superior products that enhance the safety, accuracy, speed and performance of law enforcement, military and firefighting professionals. Built on a foundation of durability, quality and value, 5.11 Tactical gear leads the industry by delivering functionally innovative gear, head to toe. LA Police Gear is proud to be 5.11 Tactical’s #1 stocking dealer in the world!

5.11 Tactical Series creates superior products that enhance the safety, accuracy, speed and performance of law enforcement, military and firefighting professionals. Built on a foundation of durability, quality and value, 5.11 Tactical gear leads the industry by delivering functionally innovative gear, head to toe. LA Police Gear is proud to be 5.11 Tactical’s #1 stocking dealer in the world!

Pay a visit to LA Police Gear at 5.11 Tactical and check out their wide variety of merchandise that’s priced to sell. LA Police Gear promises extremely fast shipping, low prices, and outstanding service.