Over the last two days we’ve been seeing the banksters plead their case in front of Financial Crisis Inquiry Commission, which is a Congressional committee of six Democrats and four Republicans. This is going to be more of a dog and pony show than an attempt to right the multitude of wrongs that the banking sector has committed. Lloyd Blankfein, the CEO of Goldman Sachs, is one of the more distasteful of the bunch. He is the financial master of disaster who is quoted saying he’s just a banker “doing God’s work.” Below is a report about Blankfein and his god-like delusion:

The chief executive of Goldman Sachs, which has attracted widespread media attention over the size of its staff bonuses, says he believes banks serve a social purpose and are “doing God’s work.”

“We’re very important,” Lloyd C. Blankfein said in an interview with The Times of London. “We help companies to grow by helping them to raise capital. Companies that grow create wealth. This, in turn, allows people to have jobs that create more growth and more wealth. It’s a virtuous cycle.”

The dominant Wall Street bank posted third-quarter earnings of $3 billion and plans to hand out more than $16 billion in year-end bonuses.

“We have a social purpose,” he told the newspaper.

Mr. Blankfein also defended the firm’s compensation, saying that the practices correlated with long-term performance.

“Others made no money and still paid large bonuses. Some are not around anymore,” he said. “I wonder why?”

He said that he understood, however, that people were angry with bankers’ actions: “I know I could slit my wrists and people would cheer.”

But he is, he told The Times, just a banker “doing God’s work.”

via Blankfein Says He’s Just Doing ‘God’s Work’ – DealBook Blog – NYTimes.com.

As stated by god Blankfein above, “We help companies to grow by helping them to raise capital. Companies that grow create wealth. This, in turn, allows people to have jobs that create more growth and more wealth. It’s a virtuous cycle.”

Let’s make some comparisons to banksters rewarding their minions and how the rest of the country is faring under the virtuousness of god Blankfein:

First let’s look at the banksters bonuses in 2008:

DiNapoli’s office estimates that the bonus pool paid by the securities industry to its employees in New York City totaled $18.4 billion in 2008 based on personal income tax collections and other factors, including industry revenue and expense trends. This represents a decline of 44 percent compared with the $32.9 billion paid in 2007. The decline is the largest on record in absolute dollars and the largest percentage decline in more than 30 years, but the size of the bonus pool is still the sixth largest on record.

Now let’s look at the proposed bonuses to be given the banksters in 2009:

Goldman Sachs, ever the poster child for banker excess, is expected to top the bonus list by paying an average of almost $600,000 per employee. As of September it had already set aside $16.7 billion for bonuses.

Update: 2010-01-15:

Undeterred by the rising anger on Main Street and the populist backlash in Washington D.C., Wall Street firms are poised to pay record bonuses for 2009.

Financial firms are on track to pay over $145 billion in bonuses for 2009, according to estimates from The Wall Street Journal. That would be up 18% from 2008 and up 6% from the current record payout of $137.2 billion in 2007.

“That’s the shocking number to me, that is really unbelievable,” WSJ Wall Street reporter Susanne Craig says of the possibility 2007’s record payout could be exceeded. via “shocking…unbelievable” wall street to pay record 145b in bonuses wsj says: Tech Ticker, Yahoo! Finance.

End update: 2010-01-15

So we have Goldman Sachs alone getting ready to hand out almost as much bonus money than the entire Wall Street bonuses in 2008. And what has the taxpayer given the banksters during this financial disaster?

Every major U.S. bank began last year on the government dole. By that measure alone, no one on Wall Street deserves a bonus.

Don’t expect such a suggestion to crop up in today’s hearings. The financial industry is so steeped in a sense of bonus entitlement that such an idea is considered outrageous.

The big banks have institutionalized the idea that you should get rich without succeeding.

The price tag for the Wall Street bailout is often put at $700 billion—the size of the Troubled Assets Relief Program. But TARP is just the tip of the iceberg of money paid out or set aside by the Treasury Department and Federal Reserve. In her book, It Takes a Pillage: Behind the Bailouts, Bonuses, and Backroom Deals from Washington to Wall Street, Nomi Prins uncovers the hush-hush programs and crunches the hidden numbers to calculate the shocking actual size of the bailout: $14.4 trillion and counting.

Now let’s see how much the banksters will be receiving in bonuses in 2009:

“Industry executives acknowledge that the numbers being tossed around — six-, seven- and even eight-figure sums for some chief executives and top producers — will stun the many Americans still hurting from the financial collapse and ensuing Great Recession.”

“During the first nine months of 2009,” the Times reported, “five of the largest banks that received federal aid — Citigroup, Bank of America, Goldman Sachs, JPMorgan Chase and Morgan Stanley — together set aside about $90 billion for compensation.“

The Times piece quotes a Wall Street insider who apparently has avoided being infected by Wall Street’s inability to see past greed and understand what’s going on in the real world. John Reed, a founder of Citigroup said: “There is nothing I’ve seen that gives me the slightest feeling that these people have learned anything from the crisis…. They just don’t get it. They are off in a different world.”

via Robert Creamer: Tax Bank Bonuses and Capital Gains of Wealthy to Pay for Jobs Program.

While the final 2009 bonus tally won’t be known until the banks release 4th Q earnings, we can see from the Washington Post graph below that compensation and bonus totals for the first 3 Qs:

Here’s an estimate for entire year compensation compared to the last three years:

With regard to bonuses, here’s a snippet from a Bloomberg piece, which indicates bonuses at the three biggest firms will total nearly $30 billion dollars. Doing God’s work doesn’t pay badly:

Nov. 9 (Bloomberg) — Goldman Sachs Group Inc., Morgan Stanley and JPMorgan Chase & Co.’s investment bank, survivors of the worst financial crisis since the Great Depression, are set to pay record combined bonuses this year.

The firms — the three biggest banks to exit the Troubled Asset Relief Program — will hand out $29.7 billion in bonuses, according to analysts’ estimates. That’s up 60 percent from last year and more than the previous high of $26.8 billion in 2007. The money, split among 119,000 employees, equals $250,400 each, almost five times the $50,303 median household income in the U.S. last year, data compiled by Bloomberg show.

via Wall Street Bonuses Rise as Big 3 May Pay $30 Billion (Update2) – Bloomberg.com.

And a video clip of the bonus pool available to the banksters:

Now we are aware of how the banksters plan to use taxpayer moneys to fatten their wallets, let’s take a look at how Americans have fared over the past year:

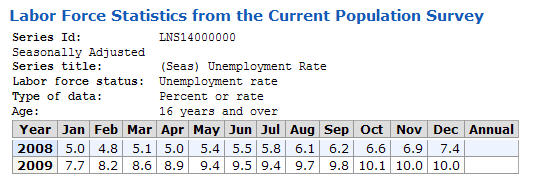

From January 2008 through December 2009 the unemployment rate has doubled from 5% to 10%. Recall god Blankfein’s above statement: “We’re very important,” Lloyd C. Blankfein said in an interview with The Times of London. “We help companies to grow by helping them to raise capital. Companies that grow create wealth. This, in turn, allows people to have jobs that create more growth and more wealth. It’s a virtuous cycle.

Unemployment rate Jan '08 through Dec '09

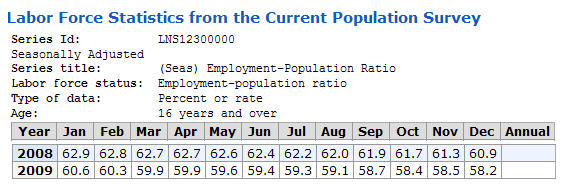

Now let’s look at the Employment-population ratio from the BLS. This shows that the percent of the population that is working has fallen from 62.9% to 58.2%:

Labor Force Statistics from the Current Population Survey

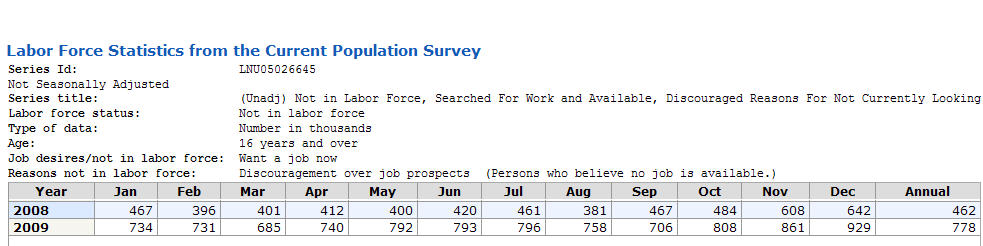

The number of people no longer considered to be in the labor force is increasing dramatically. From Jan ’08 through Dec ’09 the number of discouraged workers has increased from 467,000 to 929,000. Those no longer in the workforce are no longer considered unemployed, which means that there are many more unemployed than the government offers in its monthly report:

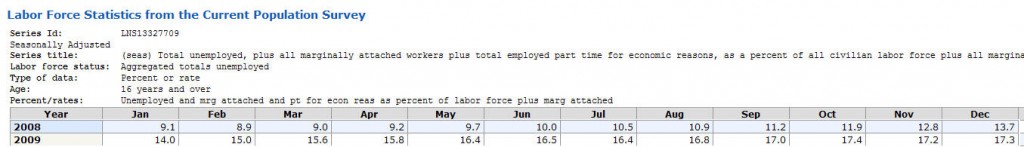

One of the most disturbing unemployment numbers may be the U6 report, which has increased from 9.1% to 17.3% in Dec ’09. This report is described as: Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force.

How about home foreclosures:

A record 2.8 million properties with a mortgage got a foreclosure notice last year, jumping 21 percent from 2008 and 120 percent from 2007, the Irvine, California-based real estate data company found.

Foreclosure notices were made on more than 349,000 properties in December, a 14 percent jump from November despite various moratoria, RealtyTrac said. It was the tenth straight month that notices topped 300,000, driving the year’s total to a record of more than 3.9 million.

via U.S. 2009 foreclosures shatter record despite aid | Reuters .

Bankruptcy filings are also on the increase:

More than 1.4 million consumer filings were recorded last year, according to AACER (Automated Access to Court Electronic Records) and the American Bankruptcy Institute. Both groups issued 2009 year-end reports this week based on data compiled from U.S. bankruptcy courts. That number compares to fewer than 1.1 million filings in 2008, making for a 32 percent increase. And 2008 was no easy year, with bankruptcies rising by one-third from 2007.

Did you earn more this year than last? Chances are you may have made less, which is a far cry from the new Wall Street bonus offerings:

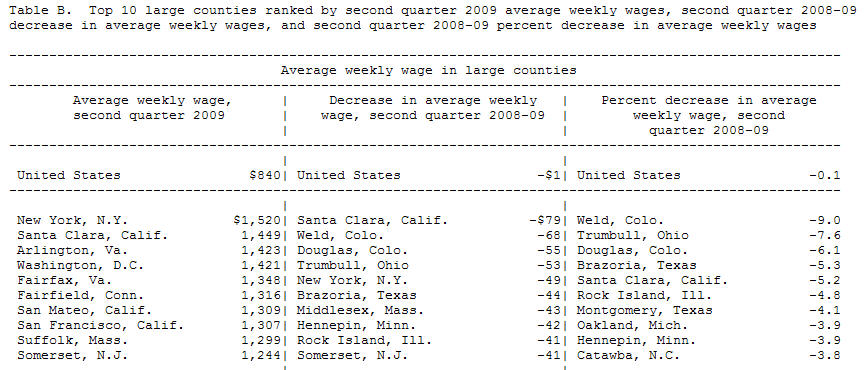

The U.S. average weekly wage fell over the year by 0.1 percent in the second quarter of 2009. This is the second consecutive over-the-year decline in average weekly wages and one of only four declines dating back to 1978, when these quarterly data were first comparable.

I think we all get the picture. The only ones who have benefited from the financial collapse are those that contributed the most to the collapse. Yet they will be partying the nights away on their out sized bonuses while millions of Americans hope that they don’t lose their jobs and homes in the coming months.

I believe that the US should levy large taxes against any bonus above a certain amount, say $75,000. The tax should increase to 75% for any amount over $1,000,000. If Britain can impose a 50% tax on bonues, I don’t see why the US can’t do the same: Britain Imposes 50% Tax on Bank Bonuses – NYTimes.com.

But I may like Simon Johnson’s idea of how to handle Wall Street bonuses even more:

Simon Johnson, professor at MIT’s Sloan School of Management and former chief economist of the IMF, says there’s a simple solution to this seemingly complex problem: “People working at our largest banks – say over $100 billion in total assets – should get zero bonus for 2009.”

via Kill Wall Street’s Bonuses Or Tax Them To Death, Says Simon Johnson.

One small ray of Wall Street must pay sunshine came from President Obama today:

UPDATE – 2:05 P.M.: In his remarks this morning announcing the proposed tax on the nation’s biggest banks, President Obama said he wants to “recover every single dime the American people are owed.” He went on:

“We’re already hearing a hew and cry from Wall Street suggesting that this proposed fee is not only unwelcome but unfair, that by some twisted logic it is more appropriate for the American people to bear the cost of the bailout rather than the industry that benefited from it, even though these executives are out there giving themselves huge bonuses.”[…]

“What I say to these executives is this: Instead of sending a phalanx of lobbyists to fight this proposal or employing an army of lawyers and accountants to help evade the fee, I suggest you might want to consider simply meeting your responsibilities.”

Just as the big banks are getting set to pay billions of dollars in bonuses next week, President Obama will announce a proposal later this morning to tax 50 of the largest banks and financial institutions over the next decade to pay back the costs of the government’s financial rescue plan.

The tax is expected to raise at least $90 billion over 10 years by taxing a percentage of a bank’s liabilities, or what is often seen as a bank’s remaining assets after setting aside certain levels of core capital, equity, common stock and government-insured customer deposits. The level of liability is one way of measuring how much risk an institution has taken on, and administration officials told reporters last night that the plan is designed in part to lower the level of risk in the financial system.

While that does nothing to curb excessive bonuses, it at least shows me that Obama may be getting enough heat from the public to act against these financially irresponsible behemoths or he and his party will be looking for new jobs in the next couple years.

The most important thing we all can do to demand some form of equity is to write our congressional representatives and let them know that this brutal treatment by the banksters isn’t acceptable and must change now:

Find your lawmakers, tell them what you think

Advertisement:

If you need insurance leads to get prices for auto, home, health, life and business insurance, take a look at NetQuote. Just complete a simple and secure online application and NetQuote does the rest by matching your application with agents that are right for you. You’ll receive up to four offers in minutes and then you contact the company that best meets your needs. The NetQuote insurance shopping process is as simple as completing the online form, comparing quotes and then choosing the insurance policy. Using Intelligent matching, NetQuote matches the consumer’s needs to the agent’s targeted lead type and location requirements. Finding the right insurance agent can be a time consuming project, but with NetQuote you w can save time and money. That’s why NetQuote is the most visited insurance shopping site on the web. Don’t make the mistake of spending hours on the phone contacting insurance agents – visit NetQoute instead.

Goldman Sachs IMO are greedy money hungry pricks and hopefull the FEDs will get to the bottom of how GS almost put this country in ruins. Hopefullly there will be some GS officers indicted. What they have done to America should be a capital offense.

[…] This post was mentioned on Twitter by Brian and layofflist, Adriane Mueller. Adriane Mueller said: Bonuses at Big 3 banks total nearly $30 billion in 2009 … http://bit.ly/4BJARB […]

[…] Sachs CEO Lloyd Blankfein’s statement, “doing God’s work” in my previous post “ Bonuses at Big 3 banks total nearly $30 billion in 2009 – Americans as a whole did not fare as well in the context of how important he was to the world, but it occurred to me in a brief moment of […]